Modern Portfolio - Theory

Markowitz, having the by far the best contribution so far in finance coined this term. It's about how we can maximize returns with reducing risk. This one is little less technical. Tune in!

Introduction

Imagine you're an explorer, standing at the edge of a vast landscape of investment opportunities. Your goal? To find the perfect balance between risk and reward, charting a course that maximizes returns while minimizing the potential pitfalls.

This is the essence of Modern Portfolio Theory (MPT), a groundbreaking concept that has reshaped the world of finance since its inception in the 1950s by Harry Markowitz.

At the heart of MPT lies the concept of the "Efficient Frontier," a theoretical boundary that separates the optimal from the suboptimal.

In this article, we'll embark on a journey through the intricacies of MPT, exploring its origins, key principles, and real-world applications.

The Birth of Modern Theory

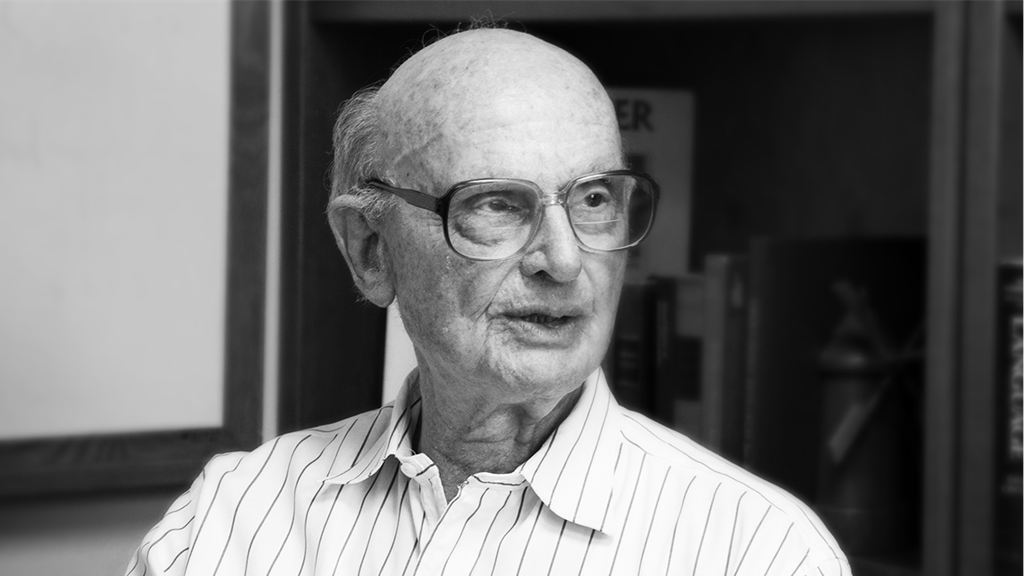

Our story begins in 1952, when a young economist named Harry Markowitz published a seminal paper titled "Portfolio Selection."

In this groundbreaking work, Markowitz introduced the world to the concept of MPT, forever changing the way investors approached risk and return. Markowitz argued that a portfolio's performance should be evaluated based on its overall risk-return profile, rather than focusing on individual assets.

By considering the correlation between assets and their respective risks, Markowitz demonstrated that diversification could significantly reduce portfolio risk without sacrificing expected returns.

The Efficient Frontier:

A Graphical Representation of MPT: To visualize the principles of MPT, Markowitz introduced the concept of the "Efficient Frontier."

Imagine a graph with two axes: the horizontal axis represents risk (measured by standard deviation), while the vertical axis represents expected return.

In part 2, we’ll explore more on the how to side of this article. Learn theory first, then we’ll go onto calculations on the next part.

The Efficient Frontier is the upward-sloping curve that connects the portfolios with the highest expected return for a given level of risk.

Portfolios that lie on or above the Efficient Frontier are considered "efficient," while those below the curve are "inefficient."

The Use of MPT

It is about deciding whether a stock can be selected or rejected, what should be the weight of the stock in the portfolio.

Decision depends on the frontier. If it’s above the frontier then it dominates other stocks, if it’s below the frontier, it is dominated by other stocks. It’s also called efficient and later one is called inefficient; as discussed earlier.

One may use coefficient of variation to decide which stocks should be selected to invest in. But all the stats and the maths for all this is in the second part of this modern portfolio concept.

Little Musing on The Capital Market Line (CML)

The CML is a line that connects the risk-free rate (typically represented by a treasury bond) to the point on the Efficient Frontier that offers the highest expected return for a given level of risk.

The portfolio that lies at this intersection is known as the "Tangency Portfolio," and it represents the optimal combination of risk and return for an investor with a specific risk tolerance.

To illustrate the practical applications of MPT, and CML, stay tuned for part 2 for more with detailed examples! Thanks for reading. Happy learning!

Love you all.